Honey, I shrunk your discretionary income - an Open Data Saskatchewan analysis

How the Bank of Canada ran up inflation during a pandemic and we're all paying for it.

The Canadian money supply

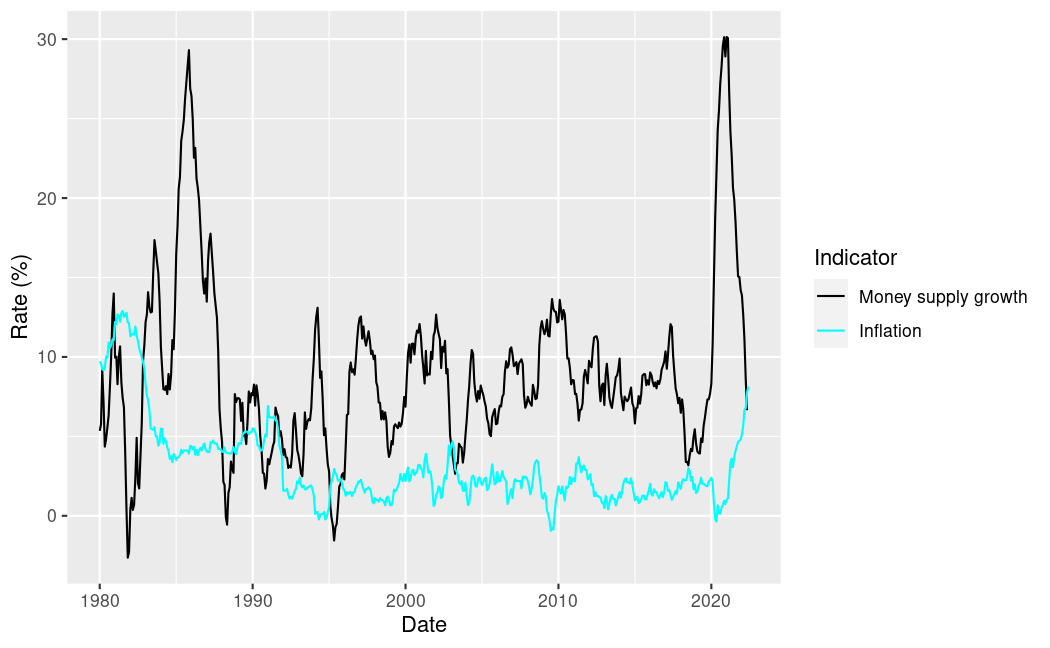

This is the most important chart in the conversation about inflation in Canada. Let me tell you why Canada’s money supply and the Bank of Canada are playing a big role in the high rates of inflation we’re currently experiencing.

Inflation in Canada right now

You've read the news articles. You've heard the pundits talk. You've seen the prices changing at the grocery store. The cost of pretty much everything is up (way up) this year. Inflation has been running at around 8 - 10% over price levels experienced last year whereas typical rates of inflation in Canada in the recent past are more in the range of 1 - 3% per year. A predictable rate of inflation at this low level of around 2% per year is perfectly tolerable for most Canadians. One needn't update the prices on menus that regularly and I can be pretty confident that my total grocery bill for the month will be roughly the same as it was for the last several months.

However, for the last year, we have experienced a departure from these low levels of inflation that we've grown accustomed to and we're all feeling it - at the pump and the grocery store. So, what happened? One story is that supply chains are broken, and this is true. That said, there has been something happening at the Bank Of Canada that Economists will be writing textbook chapters about for years to come.

To illustrate the issue, let's first take another look at the Canadian money supply. The money supply is the total of all Canadian currency that is in circulation. It includes more than just paper and metal currency that the Bank of Canada prints though. The true definition is a bit weird to wrap one's head around, but it's safe to just say that this is the total value of Canadian dollars out there that are available to be used to buy goods and services. And, with supply and demand factors at play, more money to buy goods will put upward pressure on the price of scarce resources/goods that money can buy. A lower money supply will put downward pressure on prices.

Now, let's look again at that chart of Candian money supply with another trend layered on top. Below is what it would look like if we take the average growth rate of the money supply between 2010 and 2020 and forecast that forward.

That trend in the money supply looks to be quite stable over the decade between 2010 and 2020. Had the Bank of Canada kept the growth rate of the money supply during the pandemic consistent with the past decade, we'd expect to see the money supply at around $1.25 trillion. Instead, it's about 30% higher at about $1.62 trillion.

Let's dig deeper! If we look at the growth rate of the money supply in Canada we can see just how unusual the Bank of Canada's actions were during the pandemic. In the chart below, we can see massive growth in money supply during the 1980s - Boomers will recall the inflation and interest rates of the 1980s as another period of economic pain - followed by a period of calm where the rate of inflation and the growth rate of the money supply between 1990 and 2020 remained quite stable. Then, in early 2020 as the pandemic began to hit Canada and unemployment reached new heights, the growth rate of the money supply sky-rockets to heights not seen in Canada since the 1980s. This, of course, is followed shortly after by the cost of nearly everything increasing significantly.

Now, the Bank of Canada isn't solely to blame here. There indeed have been and continue to be substantial supply chain disruption caused by the impact of the pandemic on labour supply and import/export patterns globally. The central bank response in the United States of America also looks similar to the Canadian situation. That said, I look forward to reading the many post-mortem economic analyses that will be written about the central bank's response to the COVID-19 pandemic in Canada.

As always, I hope you enjoyed this brief essay on business and economic trends in Canada. If you did enjoy reading this, please share with others by forwarding this email, posting on social media, or, if that's not your thing, take a minute to fill out a 2 question survey on what you read today.

Bottom line

I’m not a professional Economist, but I play one in this note. Obviously, the Bank of Canada isn’t solely responsible for the high inflation we’re experiencing right now. Supply chains are stressed and international tension (ie war in Ukraine) is pushing energy prices up. However, it is the mandate of the Bank of Canada to keep inflation between 1 - 3% per year, so there is that ;)

Support this writing

If you like what you’ve read here, then you are probably already doing the best thing you can to support my writing, and that is to subscribe. Another thing you can do to help support me, and it’s a close second to subscribing yourself, is to share this writing with a friend, colleague, boss, enemy, or whomever and tell them what you enjoyed in this article. If you’ve just received this article forwarded to you by a friend, colleague, employee or enemy, then I’d love it if you’d hit the button below and subscribe to read more.

*Final note: If you are a long-time subscriber, you will have noticed that I’ve switched to writing on Substack and so you’ll see a few differences in format and a move from my typical branding of Open Data Saskatchewan. Enjoy!